Opening

You’ve probably seen the headlines: “Earn $500/week from your phone” or “Get paid for simple tasks.” This article takes a different approach. Instead of hype, we’ll explain how GPT (Get-Paid-To) platforms actually work, why some payouts take longer, and why two people on the same app get wildly different results.

By the end, you’ll know whether this model fits your situation—or if you should skip it entirely.

TL;DR

Direct answer: GPT platforms are legitimate, but they operate on advertiser validation timelines (instant to 30+ days), country-specific offer availability, and compliance rules that don’t guarantee outcomes.

#1 limitation: Not every completed task pays out. Advertisers reject completions for fraud flags, validation failures, or KYC mismatches—even when you followed instructions perfectly.

Realistic timeline: Credits may clear instantly or within hours, but some take days (longer for sensitive offers). Cashouts are often minutes–hours, but sensitive offers may be held until advertiser approval—up to ~45 days.

The upside: Flexible and easy to start. In strong markets, users earn anywhere from $10 to over $1,000 monthly—though most regions see smaller amounts. Location and compliance matter more than effort alone.

Who this works for: People with genuine spare time who accept delays, rejections, and unpredictability.

Who it doesn’t work for: Anyone needing reliable income, immediate payouts, or passive earnings.

The location factor: Your country determines offer availability and payout rates—this isn’t a level playing field. VPNs don’t bypass this; they trigger fraud systems that reject tasks and ban accounts.

What Most Reward Apps Don’t Explain (Before You Start)

Most people land here for one of three reasons: they’ve seen earnings claims that feel too good to be true, they’ve already had a bad experience with a shady app, or they’re staring at a “pending” reward wondering if they’ll ever get paid.

What Google results imply

Search for “best reward apps” and you’ll find the same pattern everywhere: “Top 10” lists, screenshots of big earnings, and bold promises about easy money. These articles are built for speed and clicks—they’re easy to skim, but they skip the parts that actually matter.

Like where the money really comes from. How approvals actually work. Why two people can follow the same steps and get completely different results.

What’s missing

There’s a “middle layer” nobody wants to talk about: validation delays, fraud checks, regional limits, and rules that can feel random until you understand the system behind them.

Without that context, people start with the wrong expectations. They see normal pending states as scams. They get frustrated for reasons that are industry-wide—not platform-specific problems.

This article fills that gap. We’ll explain the mechanics first, discuss the trade-offs second, and position specific platforms (including Freeward) only as conditional examples—not default solutions.

The Reality Framework: 5 Things That Explain Almost Every GPT Experience

Most “reward app” questions come down to five fundamental concepts. Understand these, and you’ll know why rewards go pending, why accounts get restricted, and why results vary so dramatically.

1) Where the money comes from

Reward apps don’t print money—they share advertiser budgets.

- Platforms act as intermediaries, keeping a margin and passing the rest to users (typically 60–90%, depending on the offer and region)

- If an advertiser rejects your action, there’s no budget to pay from—so you won’t get credited

- The platform is the messenger, not the decision-maker on most rejections

2) How the reward actually moves (the real flow)

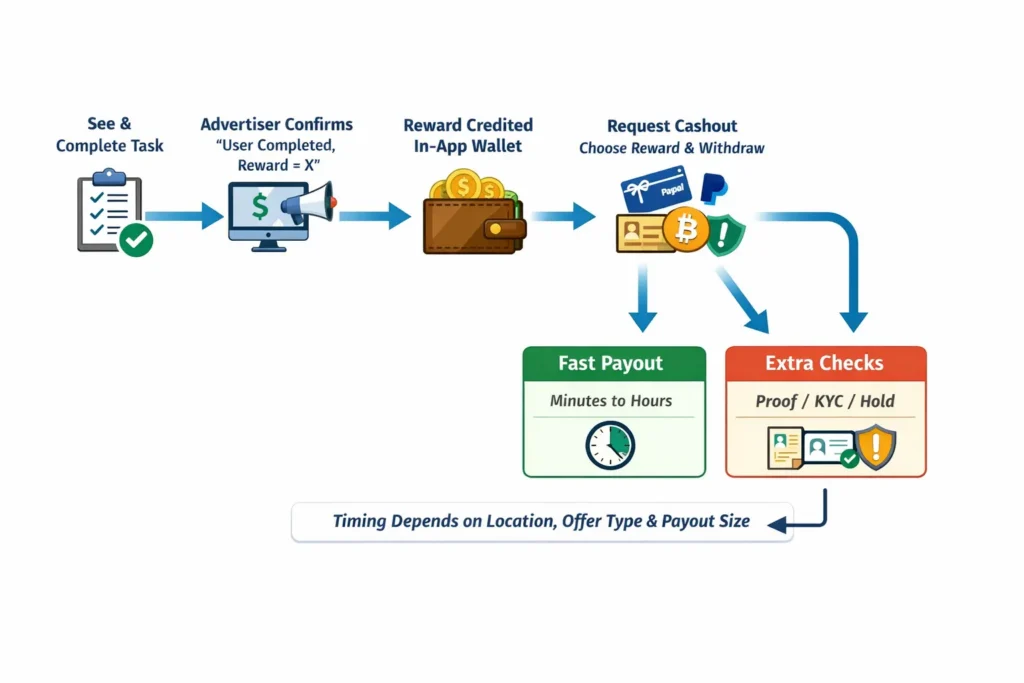

The typical flow: You complete the task → the advertiser/ad network confirms it → your in-app wallet gets credited → you request a cashout → it goes into pending → it’s reviewed and paid.

Most payouts process quickly (minutes to hours), but sensitive cases can require proof, KYC verification, or a hold until final advertiser approval (often 30–45 days for high-value offers).

3) Why “pending” happens

“Pending” is simply the waiting room while the advertiser checks your action. They’re looking for:

- Location matches (are you really where you claim to be?)

- Fraud signals (suspicious patterns, VPN usage, multiple accounts)

- Retention metrics (did you actually use the app/service?)

- Payment validity (legitimate payment method, not flagged cards)

Platforms can review and escalate issues, but they can’t override an advertiser’s final decision.

4) Why platforms can be strict

Filtering isn’t personal—it’s risk management. A handful of risky users can trigger chargebacks that cost platforms thousands in penalties.

That’s why VPNs, multiple accounts, and unusual cashout patterns often lead to holds or restrictions. The platform is protecting itself from advertiser penalties, not trying to withhold your $5.

5) What you can actually control

Location and device affect what you see and what it pays—making VPN use counterproductive and risky.

For smoother results:

- Use one account with your real connection

- Follow instructions carefully (don’t improvise)

- Don’t rush through high-value offers

- Don’t count money until it clears and hits your payment method

What Most Users Don’t Expect (And Why They Quit Early)

Let’s address the gap between expectations and reality:

Expectation: “I’ll earn a consistent amount per hour.”

Reality: Your “hourly rate” swings wildly. Offers come and go, surveys screen you out, and what you see depends heavily on location and device—sometimes more than effort.

Expectation: “If I complete a task, I’ll get paid.”

Reality: Completing the steps isn’t always the finish line. The advertiser still has to validate your action, and some completions get rejected based on offer rules, fraud signals, or mismatched data.

Expectation: “Support will fix my pending rewards.”

Reality: Support can investigate and guide you, but they can’t rewrite an advertiser’s decision. If the advertiser doesn’t approve it, there’s usually nothing the platform can “push through.”

Expectation: “Cashouts are always instant.”

Reality: Many platforms can process cashouts quickly (often minutes to hours), but high-risk cases may need manual review, proof submission, KYC verification, or a hold—and sensitive offers can be held until final advertiser approval (sometimes 30–45 days).

Who Should NOT Use GPT & Reward Platforms

Be honest with yourself. If any of these describe you, this model will frustrate you:

You need money right now. Validation, pending periods, and occasional holds mean you may wait days—or longer in sensitive cases.

You expect guaranteed income. Offers come and go, and advertiser approval isn’t predictable.

You want passive income. This is active work: reading instructions, completing steps, and staying compliant.

You’re in a low-offer region. Location strongly affects offer availability and payouts—you may spend more time searching than earning.

You hate bureaucratic processes. Pending states, KYC requests, proof checks, and policy rules are built into the system.

Your time is expensive. If you have better-paying options, GPT won’t compete on ROI.

Better alternatives

Need fast cash? Part-time gig work, tutoring, or freelancing pays faster and more reliably.

Want passive income? Build a skill-based asset (content creation, coding, design, sales funnels) rather than chasing tasks.

High time value? Focus on work that scales beyond hourly effort.

If You Want to Try: A Realistic Path Forward

If you’ve read this far and it still sounds reasonable, here’s the safest way to approach it.

Step 1: Check your variables

- Are you in a region with decent offer volume?

- Can you use a real connection (no VPN)?

- Do you have consistent spare time most days?

- Can you handle waiting for validation (sometimes days, occasionally longer on sensitive offers)?

If not, lower expectations—or wait until your situation changes.

Step 2: Treat “pending” as normal

Assume tasks may sit in pending while they’re verified. Don’t count earnings until they clear.

Step 3: Prioritize accuracy over speed

Follow instructions precisely. Don’t rush, don’t multitask aggressively, and avoid anything that looks automated. Clean behavior reduces rejections.

Step 4: Don’t rely on one task type

Mix surveys, installs, and other offers so one rejection doesn’t kill your momentum.

Step 5: Track your real return

Only calculate earnings ÷ time after credits clear and payouts are completed. That’s the number that tells you whether it’s worth continuing.

Where Freeward Fits (If It Fits at All)

Freeward is a transparency-first GPT platform. It doesn’t sell “easy money.” It’s built for people who want clear rules, predictable handling, and real rewards—without the hype.

What a “good” Freeward experience looks like

- You complete tasks, get credited (often as virtual currency), and redeem rewards you actually want

- Cashouts are typically processed fast (often within ~4 hours)—unless an offer is sensitive or the account looks risky (then a hold/KYC/proof check may apply)

- You understand that the real waiting is usually advertiser validation, not the platform “pressing a button”

Freeward is a fit if you:

- Want a rules-first platform that explains pending/rejections instead of hiding them

- Prefer predictable cashout processing (PayPal, gift cards, crypto, in-game currency)

- Care about account safety and long-term access more than “quick wins”

- Are converting spare time into small wins, not trying to replace income

- Can use a real connection (no VPN) and follow instructions carefully

Freeward is not a fit if you:

- Need guaranteed income or “instant” money

- Plan to use VPNs to chase higher payouts (location is core to validation)

- Won’t do KYC/proof checks when a case is high-risk or a reward is sensitive

- Are in a region with very low offer availability and expect US-like results

No-pressure decision

If this sounds like too much process, that’s a valid outcome. Freeward is intentionally not for everyone—because fewer informed users leads to better outcomes than lots of disappointed ones. informed users leads to better outcomes than lots of disappointed ones.