Cryptocurrencies have become increasingly popular as a means of investment and earning passive income. In 2023, there are numerous opportunities to earn free crypto through various methods, both with and without financial investment.

This blog post will tell you about the most profitable ways to earn free crypto. Whether you are a seasoned crypto enthusiast or a beginner looking to venture into the crypto world, these methods offer you exciting prospects for growing your digital asset holdings.

Methods to Earn Crypto Without Investment

There are several methods that you can use to earn crypto without investments. These methods are:

- Freeward Platform

- Crypto Games

- Surveys and Offers

- Faucet

- Airdrops

- Affiliate and Referral Programs

Freeward, Best Method

For those interested in getting cryptocurrency without spending money, Freeward offers a legitimate and rewarding platform.

Freeward is a trustworthy reward platform that provides users with the opportunity to earn free crypto by participating in simple tasks.

These tasks include

- Taking surveys

- Playing games, and

- Watching videos

By registering for free on the user-friendly platform, you can start collecting coins immediately.

Once you collect a sufficient amount of coins (5000 coins or $5 worth), you can exchange these coins for free crypto, which is swiftly delivered to you. Additionally, Freeward offers a variety of rewards to cater to different preferences.

Join Freeward, a free Litecoin earning site, and get a free Litecoin giveaway.

How to Earn Crypto on Freeward?

To get started with Freeward, you need to follow the steps below:

- To begin earning free crypto with Freeward, visit their website and sign up. You can register using your Google, Facebook account, or your email address.

- After registering, you can start collecting coins by completing various tasks available on the platform.

- Once you’ve collected enough coins, you can exchange them for free crypto. When your earned coins reach the equivalent of $5 or 5000 coins, you can initiate the exchange for crypto.

Crypto Games

Playing crypto games is an entertaining and innovative way to earn passive income within the cryptocurrency space. Crypto games, particularly those adopting the Play-To-Earn (P2E) model, offer a great way to earn free crypto without requiring any initial investment.

These games provide players with many opportunities to collect cryptocurrencies through various in-game activities.

Discover legitimate ways to obtain Apex Coins, the in-game currency in Apex Legends, through our guide on ‘How to Get free Apex Coins.’

For instance, certain Player vs. Player (PvP) games reward players for their victories against fellow gamers.

Alternatively, some games allow players to mine or gather valuable resources within the virtual environment, which can later be sold for cryptocurrencies.

Moreover, in some games, players can acquire NFTs as rewards, and these digital assets can be sold on third-party marketplaces for a profit.

The mechanics of earning in P2E games can vary, with each game presenting distinct methods for players to accumulate crypto rewards.

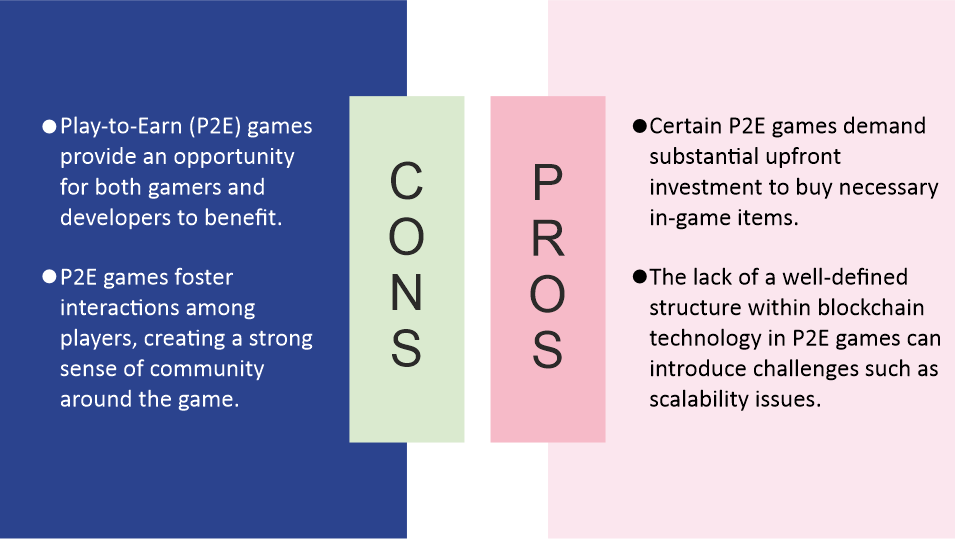

Pros

- Play-to-Earn (P2E) games provide an opportunity for both gamers and developers to benefit.

- P2E games foster interactions among players, creating a strong sense of community around the game.

Cons

- High Entry Costs: Certain P2E games demand substantial upfront investment to buy necessary in-game items.

- Challenges in Blockchain Technology: The lack of a well-defined structure within blockchain technology in P2E games can introduce challenges such as scalability issues and network infrastructure concerns.

Surveys and Offers

Several websites offer small amounts of cryptocurrency as rewards in exchange for participating in surveys, trying out new products, signing up for services, or completing other micro-tasks.

These websites often collaborate with advertisers to bring users various offers that they can engage with to earn cryptocurrency. These methods are accessible to individuals globally and offer a flexible way to eearn cryptocurrency rewards over time.

Pros

- Earn Crypto: Taking surveys can be a convenient opportunity to earn cryptocurrencies without investing money.

- Low Barrier to Entry: Participating in surveys is typically accessible to anyone with an internet connection.

- Diversification: Engaging in surveys across different platforms can allow you to collect a variety of cryptocurrencies

Cons

- Earnings Potential: The compensation from surveys is typically relatively small, especially when compared to the potential gains from successful crypto trading.

- Time-Consuming: Completing surveys can be time-consuming, and the compensation might not adequately reflect the amount of time and effort you put in.

- Privacy Concerns: Some survey platforms might require personal information.

Faucets

Faucets are websites that distribute small quantities of cryptocurrency. They offer an ideal entry point for individuals seeking to earn free crypto through uncomplicated tasks like solving captchas or watching advertisements.

These platforms are particularly suitable for beginners who lack specialized skills or prior crypto knowledge, as they do not need any investment or trading involvement. Some examples of crypto faucets include FreeBitcoin, Moon Bitcoin, and Satoshi Quiz.

Pros

- Free Cryptocurrency: By completing simple tasks, users can earn free crypto through the best crypto faucet platforms.

- Unlimited Earning Potential: Crypto faucet users can continue completing basic tasks and earning crypto rewards from the same faucet.

Cons

- Scam Faucets: Some crypto faucet apps can be fraudulent. Users might not receive rewards even after completing tasks.

- Time Consumption: Certain cryptocurrency faucets can be time-consuming, with tasks that might be tedious compared to the small rewards offered.

Airdrops

Airdrops provide a convenient way for cryptocurrency enthusiasts to acquire free tokens.

Cryptocurrency airdrops are a marketing strategy adopted by businesses to distribute tokens to active crypto traders either freely or in return for minimal promotional involvement.

These airdrops grant coins without charge, although some may require minor promotional tasks such as sharing, posting, or registering on a platform within the blockchain community.

Pros

- Increased User Adoption: Airdrops encourage people to try new cryptocurrencies without investing money.

- Broad Token Distribution: Airdrops distribute tokens widely, enhancing liquidity and trading volume on exchanges.

- Marketing: Airdrops create a cost-effective approach to project promotion.

Cons

- Fraud Risk: Scammers may exploit airdrops with fake accounts or bots to gain tokens illicitly.

- Resource Investment: Despite cost-effectiveness, airdrops still require resources and time to plan and execute.

Crypto Referral Programs

Crypto referral programs, also known as refer-to-earn programs, offer individuals the opportunity to earn cryptocurrency by inviting new users to join a specific cryptocurrency platform or network.

These programs are designed to promote the adoption and use of a particular cryptocurrency or blockchain-based service. By referring friends, family, or colleagues to these platforms, individuals can earn rewards in the form of cryptocurrency.

In a crypto referral program, participants typically need to provide a referral link or code to the people they’re inviting.

When the new users sign up for the platform or service using the provided referral link or code, the person who made the referral becomes eligible to receive a reward in the form of cryptocurrency.

Earn Free Bitcoin in 2023 via platforms such as Freeward that offers users the opportunity to earn free Bitcoin.

Examples of popular cryptocurrency platforms that offer referral programs include Bybit, Paxful, and CoinLedger.

Pros

- User Acquisition: Referral programs can effectively attract new users to the platform.

- Loyalty and Engagement: Referral programs can also enhance user engagement and loyalty.

- Cost-Effective Marketing: Referral programs can be more cost-effective compared to traditional advertising methods.

- Network Growth: Referral programs can help grow the platform’s user base, and thus create a larger network that will potentially attract more liquidity and trading volume.

Cons

- Risk of Fraud: Referral programs could potentially be exploited by users creating fake accounts or engaging in fraudulent activity to earn rewards.

- Negative Impact on User Experience: If not implemented thoughtfully, referral programs could create a negative user experience.

Methods to Earn Crypto with Investment

In addition to the methods we discussed above, there are various investment opportunities available in the crypto space that you can take advantage of to earn passive income. In what follows, we will explore some of the best methods to earn crypto through investment.

- Staking

- Liquidity Mining

- Lending

- Yield Farming

- Trading

Staking

Staking is a popular method to earn crypto by participating in the proof-of-stake (PoS) consensus mechanism of various blockchain networks. By locking up a certain amount of tokens in a wallet, stakers help secure the network and, in return, receive staking rewards.

Unlock the potential for fast and online income with our guide on the ‘10 Best dirty Ways to Make Money From Home Fast and Online.’

Staking rewards can vary depending on the project and the duration of the staking period. Some popular staking cryptocurrencies, such as Cardano, Polkadot, and Tezos, offer staking opportunities with varying reward structures.

How to

Staking cryptocurrency can be a bit confusing for beginners, but it becomes quite easy and straightforward once you get the hang of it.

- Acquire a cryptocurrency that employs the proof of stake mechanism: Not all cryptocurrencies support staking.

- Buy the Cryptocurrency: Once you have selected the cryptocurrency that supports staking, purchase the desired cryptocurrency from cryptocurrency apps or exchanges.

- Transfer your crypto to a blockchain wallet: After purchasing your crypto, it will be available on the exchange where you bought it.

Create a wallet, select the option to deposit crypto, and choose the type of cryptocurrency you want to deposit.

This will generate a wallet address. From your exchange account, select the option to withdraw your crypto and provide the wallet address to complete the transfer.

- Join a staking pool: Most cryptocurrencies use staking pools, where traders pool their funds to increase the likelihood of earning staking rewards. Research the available staking pools for your chosen cryptocurrency.

- Start earning: Once you’ve selected a pool, stake your crypto to it through your wallet, and you will start earning rewards.

Pros

- Staking is a more environmentally friendly alternative to mining.

- Staking is considered less risky than traditional trading because it involves holding and supporting established blockchain networks.

- Staking offers the potential for high returns on investment in the form of staking rewards.

- Unlike mining, staking does not require specialized hardware or expensive equipment.

Cons

- The value of staked crypto is subject to market fluctuations, which can impact the overall value of the staker’s investment.

- Some staking platforms have lockup periods during which stakers cannot access their staked tokens.

- Staking pools often charge fees for their services, which can reduce the overall returns for individual stakers.

- Staking comes with a learning curve, especially for newcomers to the crypto space.

Liquidity Mining

Liquidity Mining is a popular method for earning passive income in the cryptocurrency space. This process involves users providing liquidity to cryptocurrency swap pools on decentralized exchanges (DEXs).

Discover Freeward, which offers users the opportunity to earn free Bitcoin while participating in simple and engaging activities.”

Once they contribute liquidity, users become liquidity providers (LPs) and receive an LP token, usually a synthetic asset that can be reinvested in other platforms to earn even higher yields.

The reward for liquidity providers comes from a portion of the swap fees paid by users, which is distributed based on each LP’s share of funds contributed to the pool.

By participating in liquidity mining, users play a vital role in creating and maintaining liquidity within the DeFi ecosystem, which enhances the efficiency of cryptocurrency transactions and trading.

Join Freeward and get Free BNB (Binance Coin) through paid surveys, games, and videos.

How to

The key steps in liquidity mining are as follows:

- Find a reputable liquidity pool to participate in, and create an accout.

- Decide on the trading pairs to provide liquidity for.

- Deposit the funds into the chosen liquidity pool.

- Begin earning rewards from participating in the liquidity pool.

Pros

- Passive Income: Liquidity mining offers a way for cryptocurrency market participants to earn passive income.

- Potential for High Yields: Liquidity mining provides the potential for high yields, making it an attractive investment strategy for both large and small investors.

- Distribution of Governance and Native Tokens: Liquidity mining facilitates a relatively equitable distribution of governance and native tokens within the DeFi protocols.

- Low Barrier to Entry: Liquidity mining is permissionless and has a low barrier to entry. Anyone with a noncustodial wallet and sufficient cryptocurrency holdings can participate in liquidity mining by providing liquidity to a protocol.

Cons

- High Exchange Commission: Some decentralized exchanges (DEXs) charge high commissions for market-making, hedging, and matching trading activities.

- Low Trading Volume: If the trading activity on a particular exchange is low, liquidity providers may not generate significant profits.

- Hacks: Liquidity mining involves interacting with smart contracts, and in some cases, these contracts may be vulnerable to exploitation.

Lending

Crypto lending is another widely popular method of earning passive income in the cryptocurrency industry. Similar to liquidity mining, this method involves depositing cryptocurrency into a lending pool.

The process works by allowing borrowers to borrow the deposited coins, and they are obligated to repay the borrowed funds along with interest within an agreed-upon timeframe.

This entire process is facilitated through the use of smart contracts. To ensure the safety of lenders, collateral is typically required from borrowers.

Unlock a world of online earning opportunities with our comprehensive guide on ‘How to Earn Money Online.’

How to

Follow these steps to start earning form crypto landing.

- Choose a Lending Platform: Select a suitable crypto lending platform.

- Select a Crypto to Lend: Carefully consider the crypto you wish to lend as you’ll need to hold it while its value fluctuates.

- Transfer Crypto to Your Crypto Wallet: After buying some crypto (for example ETH), transfer it to a crypto wallet you control.

- Deposit Your Crypto: Connect your wallet to the lending app of your choice and locate your crypto in the “supply” list. By depositing your crypto, you contribute to a large lending pool, similar to a money market.

- Earn Interest: Now that your crypto is part of the lending pool, you’ll earn a proportional share of the interest as others borrow from the pool.

- Withdraw Your Crypto and Earnings: Once you’re done with lending, you can withdraw your crypto and the interest you’ve earned.

Pros

Crypto lending offers several benefits, including:

- Crypto lending offers accessibility without the need for a credit check. This makes it available to a broader range of borrowers who may not be eligible for traditional bank loans.

- Borrowers can benefit from lower interest rates compared to traditional bank loans.

- Crypto lenders can generate passive income on their crypto holdings at significantly higher rates than traditional savings accounts.

Cons

Crypto lending comes with its own set of risks and uncertainties which are explained below.

- Liquidation Risk: If the value of the collateral falls below the required level, borrowers must add more liquidity, or else they face the risk of liquidation.

- Loan-to-Value (LTV) Ratio: The LTV ratio measures risk by comparing the loan value to the market value of the collateral.

- Late Repayment: Borrowers who fail to repay on time face liquidation and incur a liquidation fee.

Yield Farming

Yield farming is a strategy employed by crypto investors to maximize their returns by frequently moving their capital to wherever they can obtain the best yield.

It involves depositing cryptocurrency into lending protocols through decentralized apps (dApps) and earning interest or other rewards in return.

The goal is to find the most lucrative opportunities for generating passive income and adapt quickly to changing market conditions.

In yield farming, investors act like farmers planting seeds and rotating crops to achieve higher yields. However, in this case, they rotate their investments much more frequently, sometimes even hourly or daily.

Step into the world of cryptocurrencies by earning free Dogecoin in 2023. Explore a range of methods to acquire Dogecoin without any investments with Freeward.

The idea is to move capital to different projects or blockchains as yields change. This can be similar to day trading in the crypto world, where careful decision-making is essential to stay profitable.

How to

Yield farming to earn cryptocurrency involves participating in decentralized finance (DeFi) platforms where users can lock their cryptocurrency tokens for a specific period to earn rewards. The process generally includes these steps:

- Choose a Yield Farming Platform: Start by selecting a DeFi platform or decentralized exchange that supports yield farming.

- Select the Cryptocurrency to Stake: Decide which cryptocurrency you want to stake or provide as liquidity.

- Transfer Crypto to Your Wallet: If you don’t have the chosen cryptocurrency, you may need to purchase it first. Once you have the tokens, transfer them to a crypto wallet that you have.

- Deposit Cryptocurrency into the Yield Farm: Connect your wallet to the selected DeFi platform and deposit the desired amount of cryptocurrency into the specific yield farming pool. By doing so, you contribute liquidity to the platform, enabling others to borrow or trade with your tokens.

- Earn Rewards: As you provide liquidity and participate in yield farming, you’ll start earning rewards for your contribution.

Pros

- Yield farming offers outstanding returns in many cases.

- Engaging with additional protocols through yield farming can qualify investors for airdrops, which can provide them with additional tokens or reward

Cons

- Yield farming requires thorough research and understanding of various DeFi protocols and platforms.

- Frequent trades and interactions on DeFi platforms can result in costly fees, which may impact overall profits and returns from yield farming.

Trading

Unlike investing, which involves a buy-and-hold strategy for the long term, crypto trading aims to capitalize on price fluctuations over shorter periods.

It refers to the buying and selling of cryptocurrencies with the intention of generating profits. It involves examining market patterns, studying price fluctuations, and conducting transactions on cryptocurrency exchanges.

To be a successful trader, you must have the necessary analytical and technical skills to analyze market charts and accurately predict price increases and decreases.

Trading relies on technical analysis, which involves evaluating statistical trends, such as price movement and volume, to identify potential trading opportunities.

Various technical analysis tools, patterns, and indicators are employed by traders to generate short-term trading signals and make informed decisions about their positions in the market.

How to

Overall, cryptocurrency trading involves the following steps:

- Choose a Cryptocurrency Exchange: To start trading, you’ll need to sign up for a cryptocurrency exchange.

- Create an Account and Verify KYC: Opening an account with a crypto exchange involves submitting personal identifying information, similar to the process of opening a stock brokerage account.

- Fund Your Account: Once your account is set up, you’ll need to connect your bank account to the crypto exchange.

- Select a Cryptocurrency: While Bitcoin and Ethereum are popular choices, you can also consider other cryptocurrencies (altcoins) based on your trading strategy.

- Start Trading: There are different ways to trade cryptocurrencies, ranging from manual trading to automated trading with the help of trading bots.

Pros

- Profit Potential: Engaging in crypto trading offers the chance to generate profits through successful trades and market prediction.

- Market Accessibility: Cryptocurrency markets operate 24/7, providing traders with the flexibility to participate in trading activities at any time.

- Volatility Opportunities: Cryptocurrencies are known for their significant price volatility, which can create opportunities for traders to profit from price fluctuations.

- Global Accessibility: Crypto trading is accessible to individuals worldwide, regardless of their location or background.

Cons

- Volatility Risk: While volatility can offer opportunities, it also introduces the risk of substantial price fluctuations and potential losses, which traders must be cautious about.

- Market Unpredictability: Cryptocurrency markets can be influenced by various factors, including regulatory changes, news events, and market sentiment.

- Lack of Regulation: The evolving nature of the crypto market and varying regulatory frameworks can pose risks related to security, fraud, and market manipulation.

- Learning Curve: Successful crypto trading requires knowledge, experience, and staying up-to-date with market trends and technological advancements.

How to Earn Crypto Safely

If you’re looking for the most profitable and convenient way to earn free crypto without any investment, Freeward is great choice.

It offers a secure, diverse, and user-friendly platform for individuals interested in accumulating cryptocurrency without the need for investment. Freeward is a standout choice in the realm of free crypto earning platforms for several reasons, including:

- Wide Range of Rewards: Freeward offers an extensive selection of rewards, including PayPal money, gift cards, and various cryptocurrencies.

- Fast and Reliable Payments: Freeward is known for its fast payment system, ensuring that users receive their rewards promptly after requesting withdrawals.

- Diverse Earning Opportunities: Freeward provides users with a plethora of earning opportunities through various tasks and offers. These tasks include a range of activities such as completing surveys, playing games, watching videos, and more.

- Secure and Legitimate Platform: Freeward is a legitimate Get-Paid-To (GPT) website that provides users with a safe and reliable environment to earn rewards, including Bitcoin Cash. The platform prioritizes user security and employs robust security measures to protect personal information and account data from potential threats.

- Professional Support: Freeward offers professional customer support to assist users throughout their journey on the platform. This support team is available to address any concerns, answer questions, and guide users.

Summary

The world of cryptocurrencies continues to expand, offering a myriad of methods for individuals to earn and grow their crypto holdings.

Whether through active investment strategies or by engaging in activities that reward participation, there is a path for everyone to explore and capitalize on the evolving crypto ecosystem.

For those willing to invest, methods such as staking, lending, yield farming, and trading provide avenues for generating passive income.

On the other hand, for those looking to earn free crypto without investment, options like the Freeward platform are available that provide an entertaining way to earn crypto while having fun.

As technology advances and new opportunities emerge, the potential for financial growth through crypto remains an exciting and dynamic prospect.

VERY good